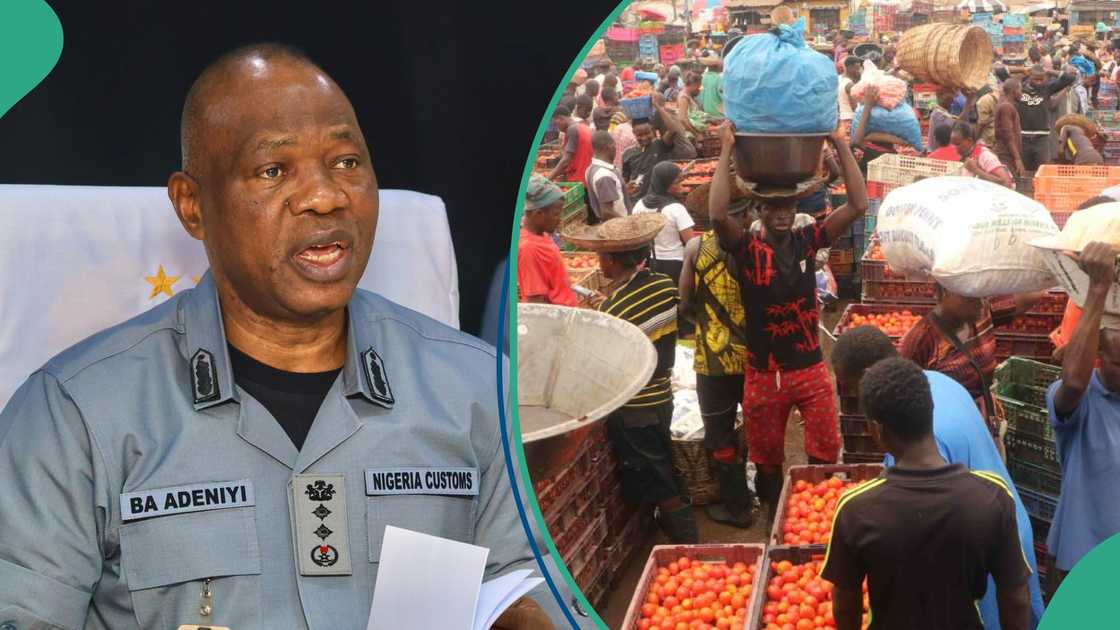

Rice, Beans To Crash As Customs Begins Implementation of Duty-Free Import of Food Items …C0NTINUE READING HERE >>>

The Nigeria Customs Service will begin implementation of zero import duty and VAT exemption on essential food items The policy covers items like maize, beans and rice to address high food prices and improve affordability for Nigerians.At least 75% of imported items must be sold through recognized commodities exchanges, with all transactions documented

Henzodaily.ng journalist Dave Ibemere has over a decade of business journalism experience with in-depth knowledge of the Nigerian economy, stocks, and general market trends.

The Nigeria Customs Service (NCS) has officially begun the implementation of zero per cent import duty and exemption of value-added tax (VAT) on selected basic food items, following a directive from President Bola Ahmed Tinubu

In a statement released by Abdullahi Maiwada, Chief Superintendent of Customs and National Public Relations Officer for the Comptroller General of Custom, the duty-free policy will remain in force from July 15, 2024, until December 2024.

Read also

FCCPC identifies those causing increase in prices of rice, yam, other food items, set to take action

Customs releases guidelines for food importers on zero duty

Customs releases guidelines for food importers on zero duty

Photo credit: CustomsNG

Source: Getty Images

Nigeria Customs explained that the initiative is part of the government’s temporary measure to mitigate current hardships and will focus on addressing the national supply gap.

Guidelines for companies to enjoy 0% import duty

According to Customs, companies looking to participate in the zero-duty importation must be incorporated in Nigeria and have been operational for at least five years.It must have filed annual returns and financial statements and paid taxes and statutory payroll obligations for the past five years. Companies importing husked brown rice, grain sorghum, or millet need to own a milling plant with a capacity of at least 100 tons per day, operate for at least four years and have enough farmland for cultivation. The Federal Ministry of Finance will periodically provide the NCS with a list of importers and their approved quotas to facilitate the importation of these basic food items within the framework of this policy. The policy requires that at least 75% of imported items be sold through recognised commodities exchanges, with all transactions and storage recorded. Companies must keep comprehensive records of all related activities, which the government can request for compliance verification. If a company fails to meet its obligations under the import authorisation, it will lose all waivers and must pay the applicable VAT, levies, and import duties. This penalty also applies if the company exports the imported items in their original or processed form outside Nigeria.

Read also

Bank directors make new proposition as they oppose billionaire Otedola, Elumelu over windfall tax

The statement added:

“Those importing maize, wheat, or beans must be agricultural companies with sufficient farmland or feed mills/agro-processing companies with an out-grower network for cultivation.”

Breakdown of the selected food items for import duty

Item Description Previous Duty Rate + Levy now suspendedHusked Brown Rice 30%Grain Sorghum – Other 5%Millet – Other 5%Maize – Other 5%Wheat – Other 20%Beans 20%

CBN slashes Customs FX rate for cargo clearance

Henzodaily.ng earlier reported that the Central Bank of Nigeria (CBN) had slashed the exchange rates for Cargo clearance following the naira’s sustained gains against the dollar in the past seven days.

The Nigerian currency had maintained a momentous gain against the US greenback after a series of interventions by the apex bank.

On Wednesday, August 7, 2024, the apex bank sold Forex to 26 dealer banks via the Retail Dutch Auction System (rDAS).

Source: Henzodaily.ng

>